A Leading Self-Directed IRA Company

Learn to Protect Your Solo 401(k) From Common Mistakes and Maximize Growth. Download now

Fill out the form to download the Solo 401(k) in Your Retirement Account guide.

ACCESS YOUR FREE GUIDE

Discover why the Equity Solo 401(k) is a superior plan for business owners.

Fast and East

Save valuable time and act quickly on opportunities that come your way.

◦ Plan is established in minutes

◦ Invest directly from plan account – no extra steps needed

◦ Lightning-fast transactions, including seamless Roth conversions

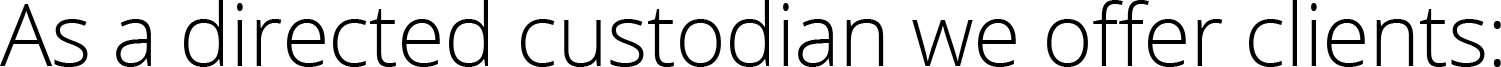

State-of-the-art management platform

Save yourself the headaches and confusion of trying to comply with Solo 401(k) rules on your own.

◦ Intuitive, comprehensive account management tools

◦ Complete recordkeeping system for IRS compliance

◦ Automated tracking saves time and effort

Turbocharged retirement investing

A self-directed Solo 401(k) provides benefits for solopreneurs that no other retirement plan can. The Equity Solo 401(k) platform unlocks the plan’s full potential.

◦ Enables investing in a wide variety of traditional and alternative assets

◦ Traditional, Roth and After-Tax buckets to maximize contributions

◦ Portion of contributions are tax-deductible

Integrated banking

Forget opening multiple accounts or requesting funds for investments. The Equity Solo 401(k) provides convenient, connected, hassle-free banking.

◦ Direct control of funds for fast, easy investing

◦ Single account for pre- and post-tax fund sorting

◦ Loan creation, Roth conversions, IRS-approved documents and more included for flat annual fee

Discover why the Equity Solo 401(k) is a superior plan for business owners.

Fast and easy

Save valuable time and act quickly on opportunities that come your way.

◦ Plan is established in minutes

◦ Invest directly from plan account – no extra steps needed

◦ Lightning-fast transactions, including seamless Roth conversions

State-of-the-art management platform

Save yourself the headaches and confusion of trying to comply with Solo 401(k) rules on your own.

◦ Intuitive, comprehensive account management tools

◦ Complete recordkeeping system for IRS compliance

◦ Automated tracking saves time and effort

Turbocharged retirement investing

A self-directed Solo 401(k) provides benefits for solopreneurs that no other retirement plan can. The Equity Solo 401(k) platform unlocks the plan’s full potential.

◦ Enables investing in a wide variety of traditional and alternative assets

◦ Traditional, Roth and After-Tax buckets to maximize contributions

◦ Portion of contributions are tax-deductible

Integrated banking

Forget opening multiple accounts or requesting funds for investments. The Equity Solo 401(k) provides convenient, connected, hassle-free banking.

◦ Direct control of funds for fast, easy investing

◦ Single account for pre- and post-tax fund sorting

◦ Loan creation, Roth conversions, IRS-approved documents and more included for flat annual fee

Assets

Assets Under Custody

and Administration**

415,000

Accounts Under Custody

and Administration**

Years

Years in Financial

Services*

Assets

Assets Under Custody

and Administration**

Transactions

Accounts Under Custody

and Administration**

Years

Years in Financial

Services*

Your Solo 401(k) Has Nearly Endless Investment Options.

REAL ESTATE

Predictable, versatile investments that fuel

your passions.

STOCKS & BONDS

Invest in publicly traded assets such as stocks, bonds, and mutual funds.

PROMISSORY NOTES

A hands-off investment with steady profit potential.

PRIVATE ENTITIES

Unleash your inner venture capitalist with your retirement account.

PRECIOUS METALS

Provided they meet minimum fineness requirements, precious metals can be held in an IRA.

Assets

Assets Under Custody

and Administration**

415,000

Accounts Under Custody

and Administration**

Years

Years in Financial

Services*

Your Solo 401(k) Has Nearly Endless Investment Options

REAL ESTATE

Predictable, versatile investments that

fuel your passions.

STOCKS & BONDS

Invest in publicly traded assets such as stocks, bonds, and mutual funds.

PROMISSORY NOTES

A hands-off investment with steady profit potential.

PRIVATE ENTITIES

Unleash your inner venture capitalist with your retirement account.

PRECIOUS METALS

Provided they meet minimum fineness requirements, precious metals can be held in an IRA.

How to get started with an Equity Solo 401(k)

In just 5 steps, you can be on your way to growing your wealth your way with your new Solo 401(k).

Getting Started is Easy

It’s as simple as 1-2-3. Open and fund your new self-directed IRA, then start investing in the almost endless possibilities.

Assets

Assets Under Custody

and Administration**

Transactions

Accounts Under Custody

and Administration**

Years

Years in Financial

Services*

Discover why more investors

choose Equity Trust.

How the Equity Solo 401(k) stacks up

See how this plan compares to similar plans on the market.

Now’s the Time to Get Set Up

Whether or not you have an investment in mind, we’ll help you set up and fund your account so you’re ready to direct your funds when you find an opportunity that fits your financial goals.

Download your Free Self-Directed IRA Guide and schedule a one-on-one session with an IRA Counselor.

Let’s talk about your financial future

Download your Free Self-Directed IRA Guide and schedule a one-on-one session with an IRA Counselor.

Call us at +18888251531 or (888) 825-1531

Discover why more investors choose Equity Trust.

Best Self-Directed IRA Company

2020 - 2025

Best Self-Directed IRA for Private Equity,

Precious Metals 2024

BBB Rating: A+

Equity Specialty Services, LLC (“ESS”) has partnered with SEPira(k), a third-party technology provider, to offer you the Equity Solo 401(k) solution to establish and manage your Solo 401(k). By combining SEPira(k)'s technology platform with ESS's customer support, you will have the tools to manage your Solo 401(k) seamlessly.

Equity Specialty Services, LLC is a services company which offers services such as acting as a solo 401(k) solution provider, offering document preparation and referral loans services and other services to assist an investor with his/her investments. Equity Specialty Services does not offer investment, tax, or legal advice, and no services offered by us should be considered to replace the need for qualified investment, tax, and legal professionals. It is for education only. Please consult your legal or financial advisor before making any financial decisions. Equity Specialty Services may receive or give referral fees from third party vendors for services it offers to investors.

*Founded in 1974 | Self-Directed IRA Custodian since 1983. The predecessor business to Equity Trust Company was established in 1974 and the IRA approved as a custodian in 1983. **Assets and accounts under custody and administration as of 3/31/25.

1 Equity Way | Westlake, OH 44145

©2025 Equity Private Client Group. All rights reserved.

Equity Specialty Services, LLC (“ESS”) has partnered with SEPira(k), a third-party technology provider, to offer you the Equity Solo 401(k) solution to establish and manage your Solo 401(k). By combining SEPira(k)'s technology platform with ESS's customer support, you will have the tools to manage your Solo 401(k) seamlessly.

Equity Specialty Services, LLC is a services company which offers services such as acting as a solo 401(k) solution provider, offering document preparation and referral loans services and other services to assist an investor with his/her investments. Equity Specialty Services does not offer investment, tax, or legal advice, and no services offered by us should be considered to replace the need for qualified investment, tax, and legal professionals. It is for education only. Please consult your legal or financial advisor before making any financial decisions. Equity Specialty Services may receive or give referral fees from third party vendors for services it offers to investors.

*Founded in 1974 | Self-Directed IRA Custodian since 1983. The predecessor business to Equity Trust Company was established in 1974 and the IRA approved as a custodian in 1983. **Assets and accounts under custody and administration as of 3/31/25.

1 Equity Way | Westlake, OH 44145

©2025 Equity Private Client Group. All rights reserved.